Homeowners are under enough pressure making monthly payments to their mortgage companies, banks, and municipal authorities, without having to worry about the unexpected costs of repairing or replacing systems and appliances.

A home warranty plan serves as added peace of mind when you are faced with all manner of expenses in your home. Once you’ve closed on a real estate deal, you certainly don’t want to be worrying about repairing, replacing, or maintenance of expensive home systems and appliances.

A home warranty gives you peace of mind, especially as a new homeowner with little or no experience in repair, replacement, and maintenance of various electro-mechanical components. Sometimes, a new homeowner will enjoy home warranty coverage courtesy of the seller of the property. This isn’t always the case, but it is certainly growing in popularity across the US.

It is regarded as a courtesy to the buyer to provide 1 year of paid home warranty protection. Sometimes, the realtor will offer home warranty coverage to the buyer as a gift. Fortunately, most home warranty plans are affordable, given the high costs of new systems and appliances in homes.

Expect to pay anywhere from $300 – $800 for home warranty coverage, depending on the level of cover you are seeking. It’s always a good idea to comparison shop at top-tier home warranty aggregator platforms like Review Home Warranties.

Once you have found a home warranty provider that meets your needs, it’s important to compare providers, coverage, and the available plans on offer. Before we delve into the inner mechanics of a home warranty plan, coverage, and functionality, it’s important to point out that these services are only available to people in the US.

Certain home warranty companies offer coverage across multiple states, while others are rather limited in terms of who is covered. Regardless, this is one of the fastest-growing markets in the US, and for good reason.

Nowadays, people simply don’t have $500+ sitting around in a checking or savings account expressly reserved for the repair, replacement, or maintenance of home systems and appliances. With so many people strapped for cash, it makes sense to consider home warranty coverage to protect against eventualities.

How do you use a home warranty plan?

The first order of business is selecting a home warranty plan. The level of coverage usually depends on the demand for homeownership in the state. There are several states which boast high population growth rates, and attendant levels of homeownership. One state worthy of mention is Utah.

According to the latest figures from the US Census Bureau, Utah has a fast-growing population, and this necessitates increased homeownership. As such, there has been a spike in demand for home warranty coverage. Utah area home warranties are increasingly provided by the following companies: Select Home Warranty, Choice Home Warranty, Pride Home Warranty, and others.

There are many steps that need to be verified and evaluated before choosing a home warranty plan. Consider the costs, the coverage, the competence, and the customer care as cases in point. Many home warranty companies offer a fabulous sales pitch, but they are slow to respond, if at all, to requests made on behalf of customers.

Current regulations in the state of Utah state that only authorized companies can issue home warranty coverage to clients. Unfortunately, there are many shady operators on the scene, making it a little difficult to select reputable providers. The best way to ascertain the effectiveness of a home warranty provider is customer satisfaction via reviews.

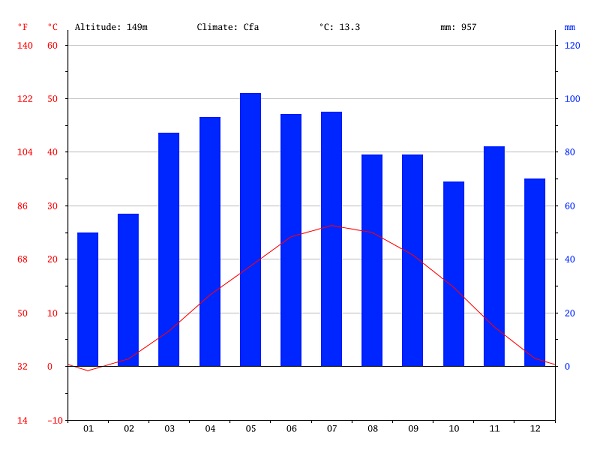

Demand for Home Warranty Coverage Determined by Climatic Conditions

Several fully comprehensive home warranty options are available including the providers mentioned earlier. American Home Guard, Select Home Warranty, America’s First Choice Home Club, and Total Home Protection dominate the scene in the state of Utah.

When you’re looking to purchase home warranty coverage, it’s important that your needs are met by the type of service being offered. Besides for A/Cs, electrical, plumbing, dishwashers, refrigerators, microwaves, garbage disposal units, and others, there are also septic systems, motors, and other elements to consider. Another point worthy of mention is the deductible.

This is the portion of the home warranty plan that needs to be met by you, the customer. The technician that is called out to evaluate faulty appliances must be paid out of your money – that is not covered by the home warranty protection. Nonetheless, there are many benefits to having home reliable warranty protection, such as not having to pay for the repair, or replacement (within limits) costs when these appliances break down.

Home warranty coverage is also gaining traction in other states in the US such as Missouri. Various elements affect the demand/supply of home warranty services across the US. For example, the Missouri area home warranties providers include the likes of Endurance Home Warranty, Pride Home Warranty, Total Home Protection, and Choice Home Warranty.

If your house is in a highly humid climate such as Florida, Missouri, or other Midwest states, summers place an unbelievable strain on AC units, and other electro-mechanical components. Winters in many states are the opposite – there are sub-zero temperatures which cause many components to stop functioning altogether.

Frozen valves, pipes, lines and other elements can cause serious damage to home systems and appliances. Therefore home warranty reviews are so important in states like Missouri. You can certainly save a lot of money if you don’t have an extended manufacturer’s warranty on your appliances, or your systems are more than 4 years old.

It is foolhardy to avoid paying the $300 – $500 annual premium and end up out-of-pocket to the tune of thousands of dollars when things really go wrong!